Donation Spreadsheet For Taxes

If these spreadsheets do not meet your needs consider a Custom Spreadsheet solution. Cash receipts are especially important when it comes to filing taxes.

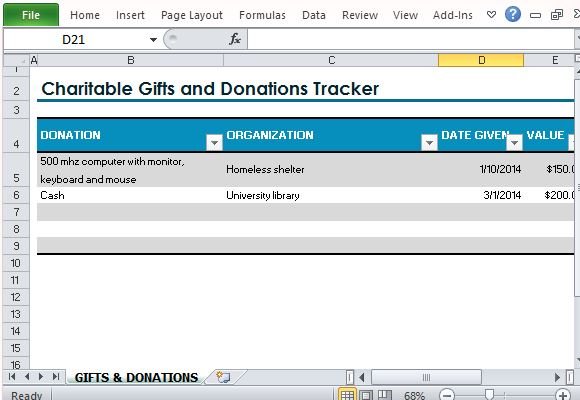

Gifts And Donations Tracker Template For Excel

If you are an employee your employer withholds income taxes from each paycheck based on a completed W-4 Form.

. If you choose to take the standard mileage you can claim 585 cents per mile during 2022. The USDAs July cattle inventory report confirms the general sentiment that the cattle cycle remains in a contractionary phase with most statistics coming in. Below are FREE charitable donation spreadsheets.

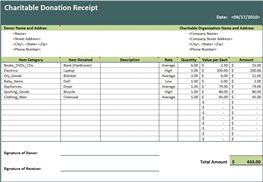

You as the donor will. A donation receipt template should comply with particular requirements when it comes to the information it contains. Do your own research online.

These programs were designed to help critically ill employees who have used up all sick and vacation time due to their illness and critically ill state employees who are burdened with unreimbursed medical bills. To claim tax deductible donations on your taxes you must itemize on your tax return by filing Schedule A of IRS Form 1040 or 1040-SR. If you want to claim gas.

Customize your cash receipt templates to include whatever information best suits your business or personal needs. The change begins with transactions starting January 2022 so it doesnt impact 2021 taxes. You can transfer a donation to our bank account.

You should include this information to make your document useful and official. The Document Foundation Purpose. The nonprofit accounting spreadsheets offered free on this site are easy to use and work well for small or start up churches or nonprofits.

There is no ceiling on the amount. However please be aware that they are they are a single entry bookkeeping system see the difference between single and double entry systems they cannot track your assets and liabilities and cannot generate a balance sheet. These enveloeps represented the categories in their budgets.

The bottom line is a donation tracking template will make your life a lot easier. The Federal Trade Commission FTC recommends searching for a charitys. You can use a donation chart tracker or even a fundraiser thermometer template.

Then you can also use it to keep track of. Claiming mileage or gas for taxes depends entirely on your personal situation. Vacation Donation Programs In the 1990s the Minnesota Legislature created two Vacation Donation programs.

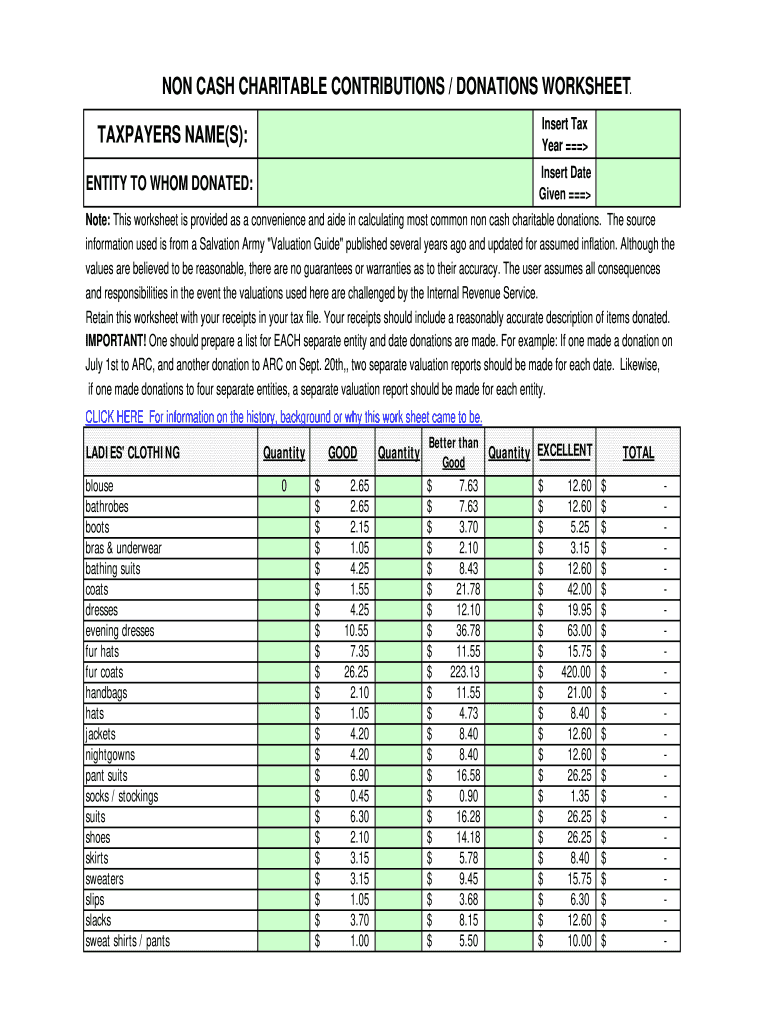

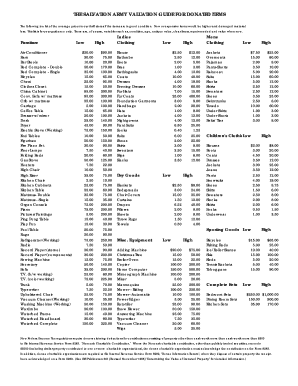

The Document Foundation Kurfürstendamm 188 10707 Berlin Germany Address of bank. These spreadsheets will help you calculate and track your charitable donations for tax deduction purposes. Use it to track all the charitable donations made in your organization.

DE12 6669 0000 0003 4973 90 BIC. The eligibility is 50 or 100 of the donation amount subject to an overall ceiling of 10 of your gross total income to certain funds and charitable institutions. The maximum limit is of 15 lakh on interest payments of a home loan for a self-occupied house.

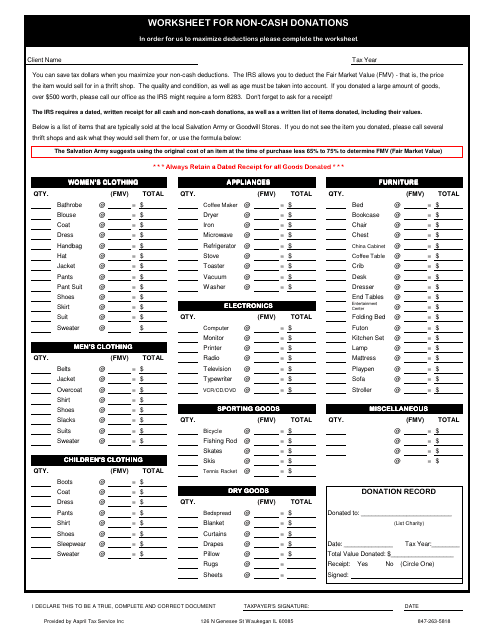

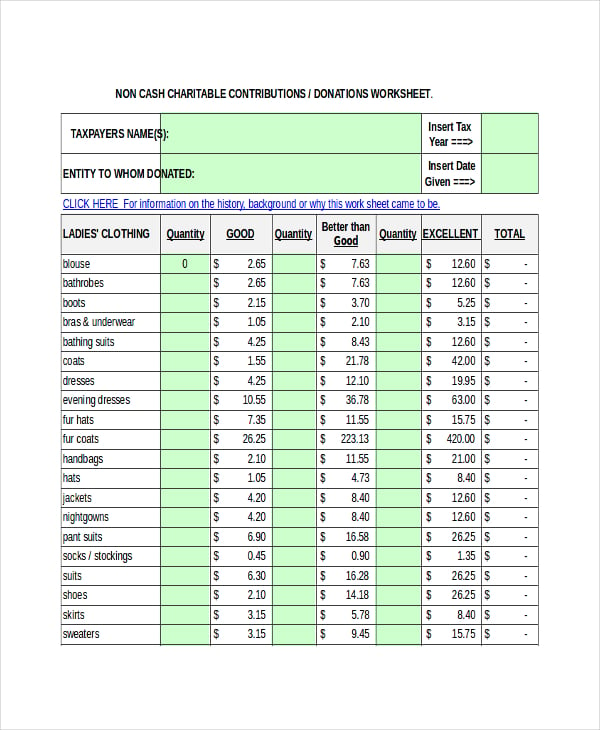

Any of these will serve the same purpose and give the same benefits. This donation receipt template has space for detailed descriptions of items donated as well as monetary value or cash donations. Is that you can use it to claim a tax deduction for household property and clothing that you may itemize in your taxes.

Beginning with tax year 2022 if someone receives payment for goods and services through a third- party payment network their income will be reported on Form 1099-K if 600 or more was processed as opposed to the current Form 1099-K reporting. VBPFDE66 Address of recipient. Do check how watchdogs like Charity Navigator CharityWatch and the Better Business Bureaus Wise Giving Alliance rate an organization before you make a donation and contact your states charity regulator to verify that the organization is registered to raise money there.

FREE Charitable Donation Receipt Our Charitable Donation Receipt automatically calculates the fair. Food clothes and whatever else they needed. Back in the old days when people were paid in cash they would take their money and divide it up in different envelopes.

Organizations can add a logo. Access Google Sheets with a personal Google account or Google Workspace account for business use. Or mileage you used to bring items to.

But if you are self-employed or make money on your investments or rental property you may need to make estimated tax payments every quarter rather than wait until you file. Section 24Home loan interest payment. Usually thats enough to take care of your income tax obligations.

This program calculates premiums evaluates insurance payments and provides historical data useful when making crop insurance decisions for multiple crops. Volksbank Pforzheim eG Westliche-Karl-Friedrich-Str.

![]()

Donation Tracking Template Free Download Ods Excel Pdf Csv

Non Cash Donations Worksheet Template Aapril Tax Service Inc Download Printable Pdf Templateroller

Donation Value Guide 2021 Spreadsheet Fill Online Printable Fillable Blank Pdffiller

![]()

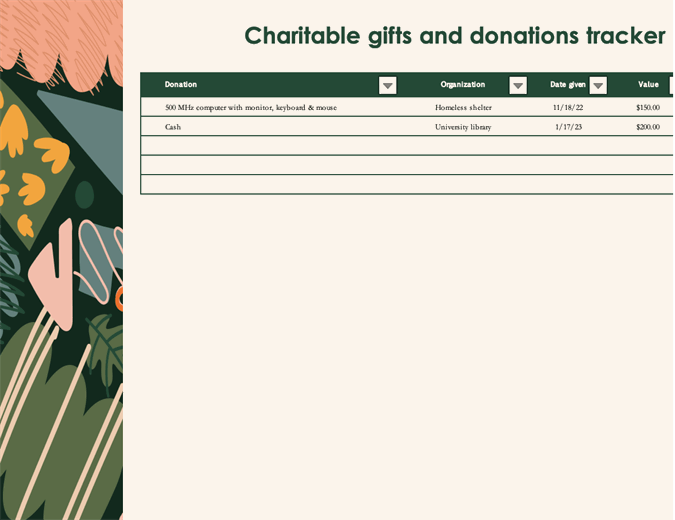

Charitable Gifts And Donations Tracker Template Excel Templates Charitable Gifts Donation Letter Charitable

Charitable Gifts And Donations Tracker

Donation Value Guide 2021 Spreadsheet Fill Online Printable Fillable Blank Pdffiller

Donation Sheet Template 9 Free Pdf Documents Download Free Premium Templates

Comments

Post a Comment